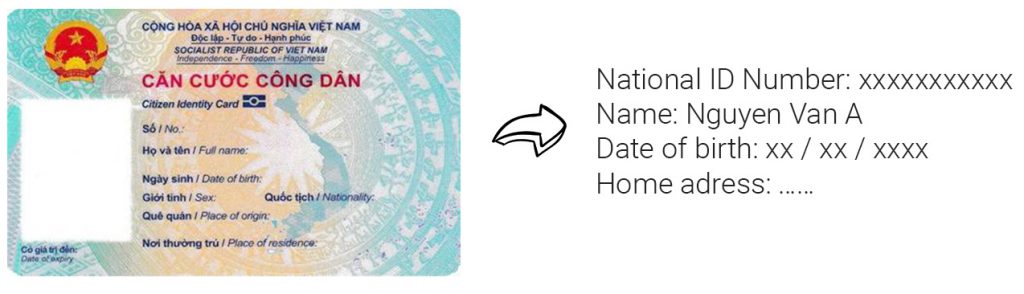

eKYC – OCR

eKYC is the expression used to describe the digitalization and electronic and online conception of KYC processes eKYC (Electronic Know Your Customer) is the remote, paperless process that minimizes the costs in the traditional KYC processes.

OCR – Optical Character Recognition defines the process of mechanically or electronically converting scanned images of handwritten, typed or printed text into machine-encoded text. This is a process of turning analog data, digital.

Our eKYC service can: (i) extract information from the image to text; (ii) Detect fake ID and (iii) detect ID card captured from other devices or not.

Our eKYC service works effectively with images from 150dpi and the accuracy rate is approximately from 95% to 98%.

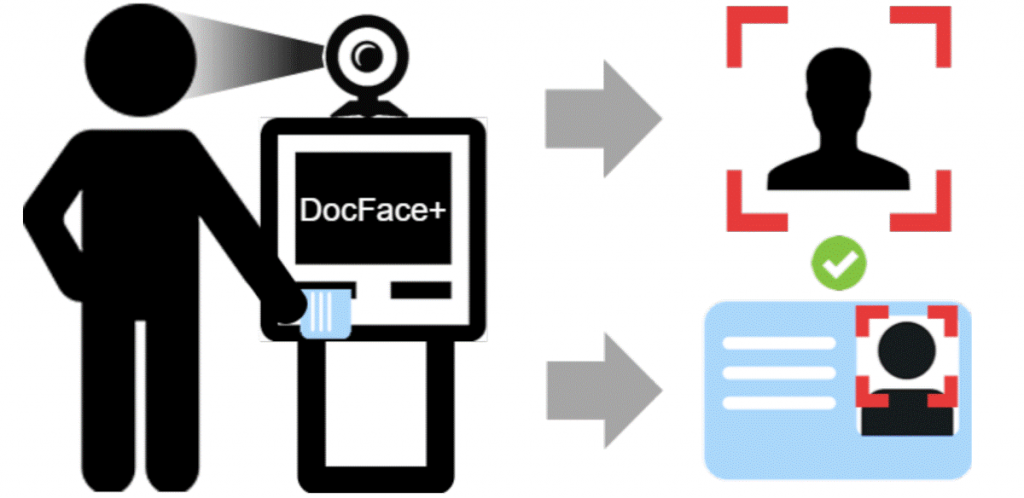

eKYC – Face Matching

e-KYC face matching, an AI-powered solution accurately verifies personal selfie photo and ID photo. This brings frictionless and lending operations to modern financial institutions.

e-KYC face matching service could:

- Recognize customer’s face automatically

- Match customer’s face between live person and provided image

- Detect “flat” images by Facial Liveness Detection

- Prevent fake face biometrics

eContract and eSignature

A digital signature is a mathematical scheme for presenting the authenticity of digital messages or documents.

Authentic electronic contracts are commercial and economic contracts entered into by parties and contracts will be signed by digital signatures, which are recognized by Vietnamese law.

The benefits of electronic contract include:

- Easier to monitor, track and find data

- Save time due to digital processes and more secure than paper documents

- Improve customer service and easily create and edit contract templates

- API allows you to integrate electronic contracts with CRM, HR etc.